How the manual is calculated in 2014 – a practical instruction

How to calculate the amount of payments and manuals by childbirth in 2014? Read on Lady-Magazine.COM Practical instruction for mothers. Calculate yourself allowance for childbirth in 2014

Probably many women who plan their pregnancy, and women who are already waiting for the birth of a new life in the near future, interests the amount of benefits by childbirth.

See also: Monthly and lump-sum maternity benefits of 2014 – how to get them?

Therefore, today we will tell you what benefits will pay the state to young mothers, and How to independently determine the amount of manual benefits.

Initially, we would like to draw your attention to the fact that In 2014, there were some changes affecting the amount of benefits. The maximum amount of earnings has changed, participating in the settlement formulas for manuals in 2014. Now Limits earnings For 2012 – 512000rub, 2013 – 568000 rub.

According to Article 9 of the Federal Law of 02.12.2013 №349 «About the federal budget for 2014 ..», The coefficient of 1.05 enhanced by 5%.

See also: What’s new in the maternal capital of 2014?

Now the sizes of benefits are:

Indexing of a single-handed manual for the coefficient of 1.05 paid on the birth of a child will occur if the child is born 01.01.2014 and later.

Estimated manual algorithm for childbirth

Sum up revenues (salary, vacation payments, premiums) for the past two years before receiving pregnancy and childbirth leave.

If these amounts are superior to the state set by the state, the maximum wage, then you will get the highest amount of the manual constituting 207 123.00 rubles. If your sums are less than the maximum maximum wage, then use the formula:

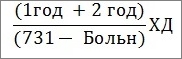

where

- 1 year – the sum of all revenues in one settlement year;

- 2 year old – the sum of all revenues for the second year, participating in the calculation;

- 731 – this is the number of days taken into account in the calculation (two years);

- Sick. – the sum of the hospital days over the time interval, taken into account in the calculations (two years);

- D – This is the number of days recorded in the hospital sheet, which is issued due to pregnancy and childbirth (from 18 to 194 days).

If yours Labor experience less than six months, then the manual in childbirth is counted, relying on the minimum.

Based on the sum of the minimum wage, which is from 01.01.2014 is 5554 rubles. per month, Guidelines for childbirth should be no lower than when the calculation is carried out on its basis.

If your real income is less than the minimum salary, then appointed Minimal benefit, established by law.

An example of how the manual is calculated by the childbirth:

Vasilyeva I.N. worked on PAO «Work» from August 2011. In January 2014, she is going to leave for pregnancy and childbirth. Vasilyeva passed a hospital leaf in the accounting list with a duration of 140 days, starting from January 21. Estimated years will have 2012 and 2013, t.E.731 Calendar Day. During this period Vasilyeva and.H 43 days was on the hospital. Her earnings amounted to: for 2012 – 598,000 rubles., For 2013 – 681,000 rubles.

In comparison with the established limits (512,000 rubles and 568,000 rubles for 2012 and 2013, respectively) its earnings are significantly higher. Therefore, the amount of daytime earnings is calculated as follows:

(512,000 rubles. + 568 000 rub.): (731 days. – 43 hospital days.) = 1569,76 rubles.

T.To. The average daily earnings, which is taken into account when calculating the benefit, should not exceed 1479.45 rubles, (this value is obtained from the calculation (512,000 rubles. + 568 000 rub.) / 730 days). Therefore, the payment of maternity benefits will be the following sum: 1479,45 rubles. x 140 days (70 days before delivery and 70 days after) = 207 123 rub.

According to the legislation of the Russian Federation, Pregnancy and childbirth is charged within 10 days From the moment when a person having insurance provided a disability sheet to obtain the necessary benefits. Their payment provides the FSS of the Russian Federation, and the employer makes the payment of benefits in the near future: a day defined as the day of salary payment.

In a situation where need to go on maternity leave (bir), and you at this time are on your childcare leave, You will need to write a few statements. In the first you ask to interrupt your childcare leave, and the second is to provide vacation on the Bir. For the calculation will take two penultimate year, that is, when you were on vacation on the Bir, as well as child care. These years may be replaced by the previous ones (according to. 1 Art. 14 255-FZ). To do this, you will need to write another statement.